Revealed: The truth behind 3 common pension myths that could affect your long-term financial wellbeing

Saving towards your retirement can be confusing, especially since pension rules and regulations are frequently updated or changed altogether. As a result, myths and misconceptions related to pensions could easily throw you off course and hinder your progress towards your long-term financial goals.

Yet since your pension is likely to be one of your main sources of income in retirement, it’s important to understand how it works.

Below, I’ve summarised some of the most common pension myths and explained the truth behind them so that you can confidently save towards your dream retirement.

1. “A pension locks money away for many years, so an easy access savings account would be more useful”

While it’s true that you can’t typically access your pension savings until age 55 (rising to age 57 from April 2028), this doesn’t necessarily mean that other types of savings wrappers are more suitable for your retirement fund.

Interest rates on cash savings accounts won’t usually keep pace with inflation over the long term, meaning that the cash you hold in the bank could, over time, lose spending power. When you are holding savings for many years, the loss of spending power could mean the difference between achieving your goals and falling short.

By comparison, a pension will invest some of your money in the stock market, giving it an opportunity to generate higher returns than you might have achieved in a savings account.

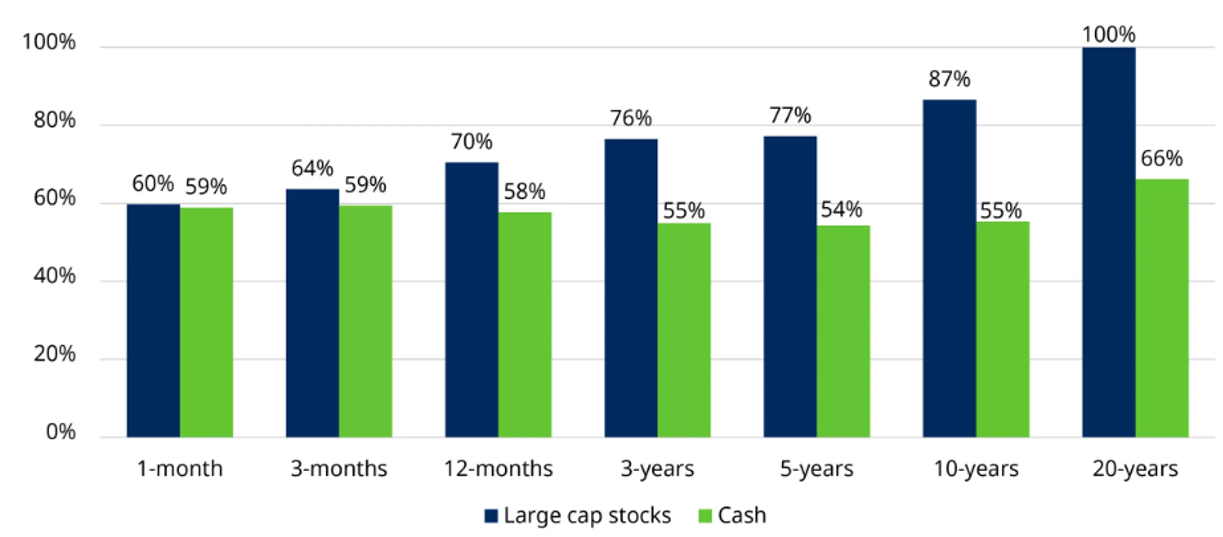

The graph below shows the percentage of time periods when returns on stocks and shares have beaten inflation compared to cash savings.

Source: Schroders

As you can see, if you’re saving for 20 years or more, stocks and shares have historically beaten inflation 100% of the time, whereas cash savings only did so 66% of the time.

Of course, past performance does not guarantee future performance, but these trends demonstrate just one of the benefits of saving into a pension over an easy access savings account when it comes to your retirement planning.

2. “I’m enrolled in a workplace pension so I’m already saving enough towards my retirement”

By auto-enrolling in your employer’s workplace pension, you’re taking the first steps towards saving for a financially secure retirement. Usually, you’ll contribute a minimum of 8% of your salary towards the workplace pension, which is composed of contributions from you and your employer, plus tax relief from the government.

While this is a great start, 8% may not be enough to ensure you are able to achieve your long-term goals. IFA magazine reports that a single person may need as much as £738,000 in your pension by the time you finish working if you’re to enjoy a comfortable retirement lifestyle.

Of course, the exact amount that you’ll need to achieve your personal goals will be unique to you. That’s why it’s vital to understand how much to contribute to your pension each month so that you can work towards your goals and enjoy the retirement you’re hoping for within your desired time frame.

I can help you to calculate this using cashflow planning. This tool enables you to glimpse your financial future, modelling different scenarios such as an increase in pension contributions, a change to your expected retirement date, or a career break. By modelling these scenarios, you can see how they might affect your income later on. As a result, you can ensure you take the right steps to address any potential shortfalls and achieve your goals.

3. “My rental property will provide my retirement income”

While property can provide a regular income, there are some important factors to consider that mean it may not be suitable as your sole source of retirement income.

The first is the amount of work and investment that can be required to maintain a rental property. If renovations or repairs are needed, they could prove costly and time-consuming to complete.

Moreover, an investment property is an illiquid asset, so it is relatively difficult to release the funds you have invested in it. You would likely need to wait until your tenant’s contract expires, then sell the property to release the funds. What’s more, you may need to pay Capital Gains Tax when selling the property, which could eat into your savings.

By contrast, you have a lot more options when it comes to accessing the funds invested in your pension. You could purchase an annuity to receive a guaranteed annual income, or you could use flexi-access drawdown to withdraw as much as you need to, as often as you need to. You can usually withdraw up to 25% of your pension pot tax-free, either as a lump sum or in smaller withdrawals, and after this you may need to pay Income Tax at your marginal rate.

So, while owning rental property certainly has some benefits, relying on it for the entirety of your retirement income might not be the most suitable for you. I can help you to create a tax-efficient retirement income strategy that helps you to achieve your goals.

Get in touch

To learn more about how you can save for retirement and achieve your long-term goals, please get in touch. Email Marnel.Stafford@fosterdenovo.com or call 07305 970959 or 0207 469 2800 to find out more about how I can help you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

| Your home or property may be repossessed if you do not keep up repayments on your mortgage. |

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate taxation advice, National Savings products, deposit accounts and some aspects of buy to let mortgages.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

Accessing pension benefits early may impact on levels of retirement income and your entitlement to certain means tested benefits.

Accessing pension benefits is not suitable for everyone. You should seek advice to understand your options at retirement.

Pension savings are at risk of being eroded by inflation.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Foster Denovo Limited is registered in England and Wales Reg No. 05970987. Registered office: Ruxley House, 2 Hamm Moor Lane, Addlestone, Surrey, KT15 2SA. Foster Denovo Limited is authorised and regulated by the Financial Conduct Authority. FCA Reg No. 462728. You can check this by visiting the Financial Services Register on the Financial Conduct Authority’s website: http://www.fca.org.uk/. The Financial Conduct Authority does not regulate taxation and trust advice and some aspects of buy-to-let mortgages. Some of the fees we charge may be subject to VAT, but we’ll let you know in advance if this is applicable. VAT No. 904 450 842. The guidance and/or advice is subject to the UK regulatory regime and is therefore primarily targeted at customers in the UK.